The Carbon Border Adjustment Mechanism Explained

The Carbon Border Adjustment Mechanism (CBAM) is part of the EU’s broader efforts to combat climate change. The EU aims for an ambitious reduction in CO2 emissions and seeks to become a climate-neutral continent by 2050. CBAM intends to prevent the risk of ‘carbon leakage’ and support the EU’s climate objectives while ensuring compliance with World Trade Organization (WTO) rules.

CBAM & Carbon Leakage

The concept of ‘carbon leakage’ arises from the possibility that companies in the EU might relocate carbon-intensive production processes to countries with less stringent environmental regulations. This could occur due to the competitive advantage of lower standards in those countries. Alternatively, EU products could be replaced by more carbon-intensive imports, effectively shifting emissions outside of Europe and undermining global climate efforts. The Carbon Border Adjustment Mechanism seeks to address this by equalizing the carbon price between domestic products and imports, thereby discouraging carbon-intensive production practices abroad.

The mechanism requires EU importers to purchase carbon certificates equivalent to the carbon price that would have been paid if the goods had been produced under the EU’s carbon pricing rules. Conversely, non-EU producers can receive deductions if they demonstrate that they have already paid a price for the carbon used in producing imported goods in their country. This approach encourages producers in non-EU countries to adopt greener production processes.

The Carbon Border Adjustment Mechanism target sectors deemed at high risk of carbon leakage, including cement, iron and steel, aluminum, fertilizers, and electricity generation. The mechanism is gradually be phased in and apply only to selected goods during the initial stages. Importers will start paying a financial adjustment from 2026 onwards.

ETS

In addition to preventing carbon leakage, The Carbon Border Adjustment Mechanism aims to complement the EU’s existing Emissions Trading System (ETS). While the ETS sets a cap on greenhouse gas emissions from certain sectors within the EU and provides allowances to prevent leakage, CBAM focuses on imported goods and their embedded emissions. By ensuring that importers pay a carbon price similar to that of domestic producers under the ETS, Carbon Border Adjustment Mechanism aims to maintain a level playing field and avoid undermining EU climate goals.

Massive Risk for Importer

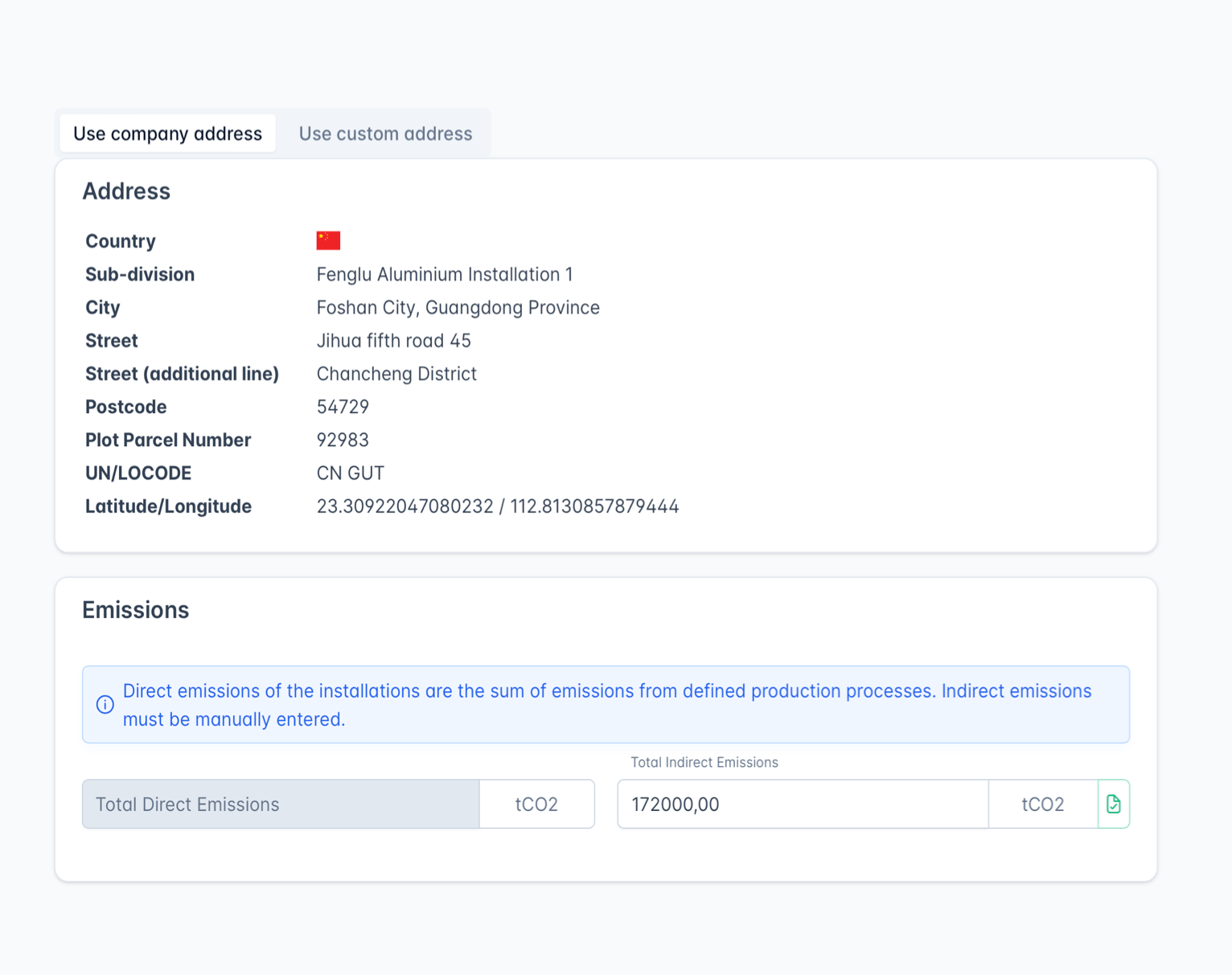

According to the Carbon Border Adjustment Mechanism regulations, importers are responsible and accountable for the data their suppliers and sub-suppliers provide.

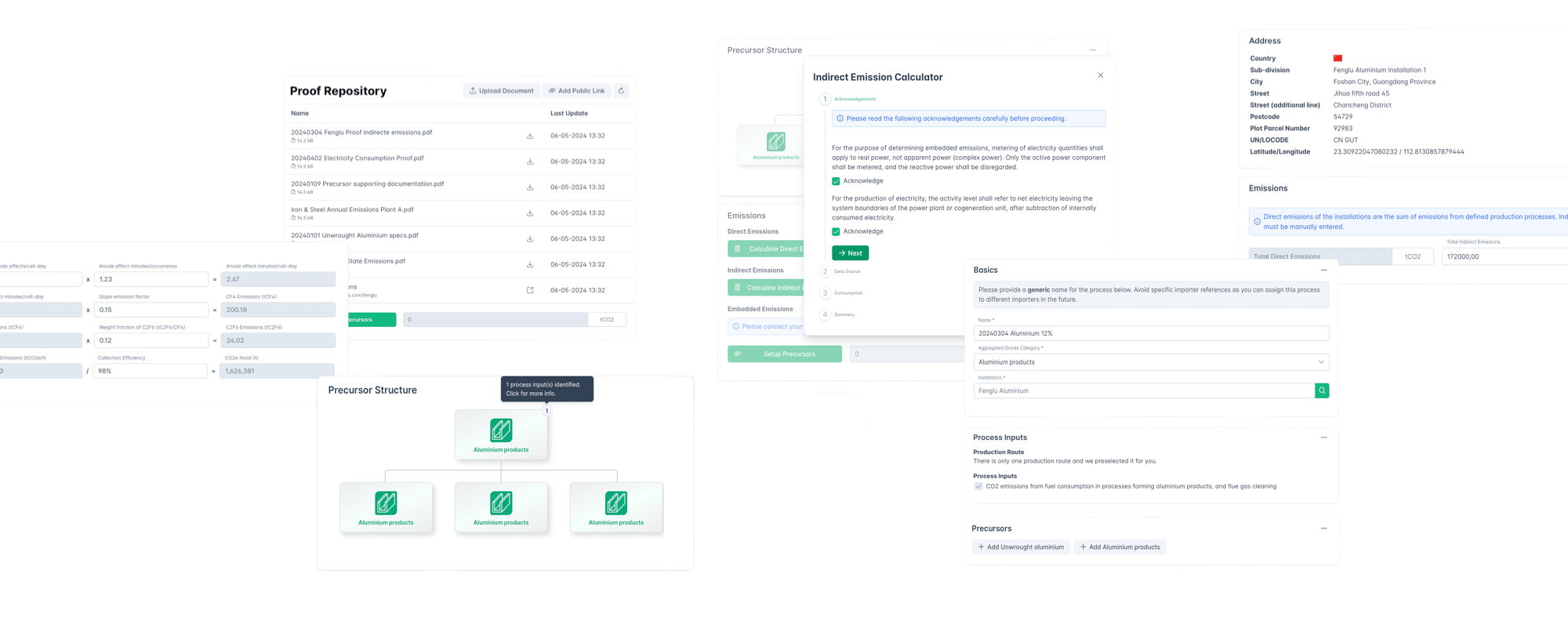

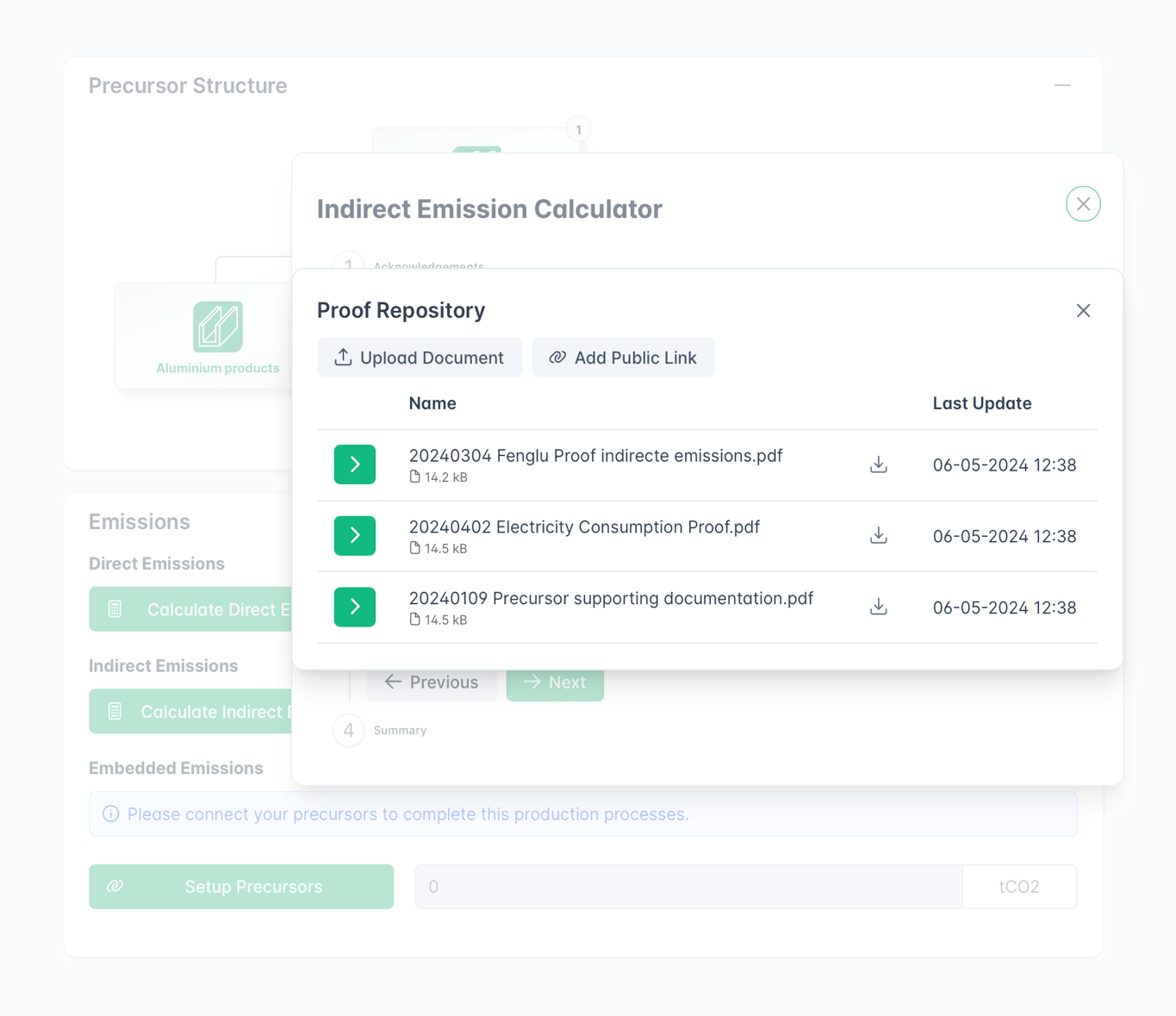

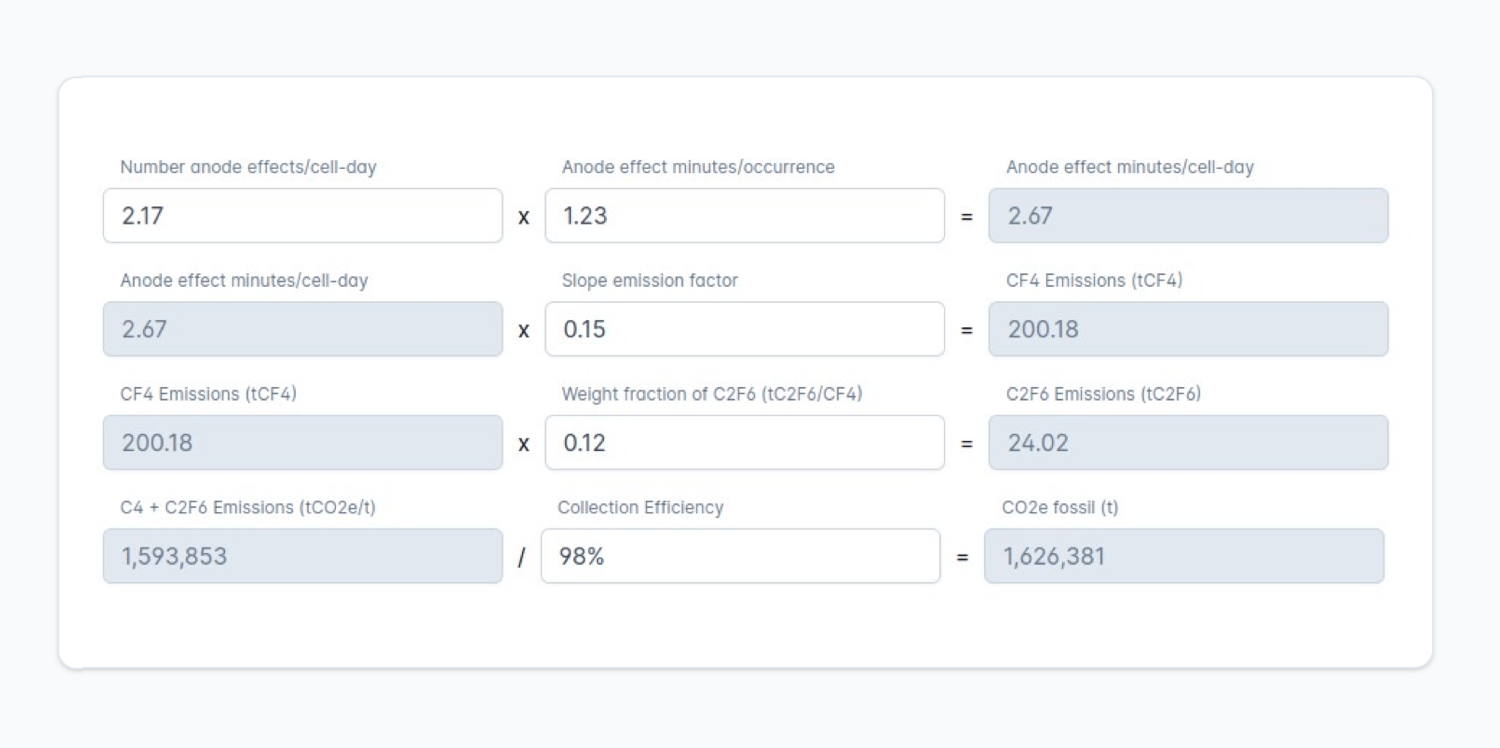

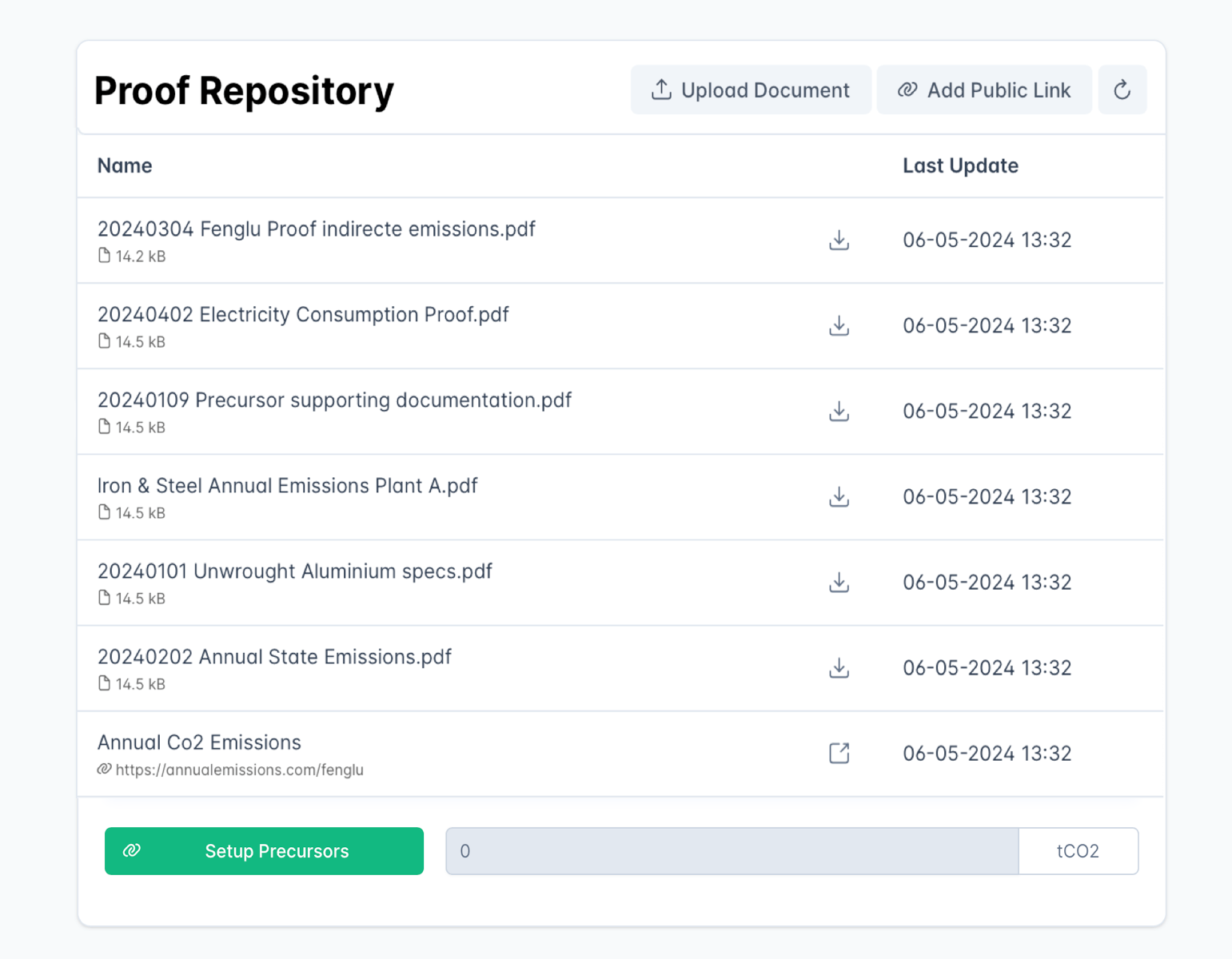

Importers have to comply to the Carbon Border Adjustment Mechanism regulation, which means they have to provide the correct carbon emission of all their suppliers. Not only the emssion data, but it is also wise to provide and store the emission calculation and the proof. If an importer is audited years after receiving goods from a supplier it is important to have all data in place. Accurate reporting of direct and indirect emissions becomes nearly impossible in Google Sheets or Excel with numerous imports, suppliers, and sub-suppliers involved.

Additionally, the complexity deepens considering the materials used and their classification under Carbon Border Adjustment Mechanism to produce imported goods, along with the potential involvement of sub-suppliers in their production chain. Importers must understand that audits encompass not only the emissions calculation of their own factory but also the calculation of emission data of their suppliers in case those suppliers provide them with precursors, which also are CBAM goods. An importer is responsible for checking if the data provided by the suppliers and sub-suppliers is correct. Therefore, a compliance platform linking importers and suppliers and storing and validating data for extended periods emerges as the optimal solution for maintaining oversight.

Dubrink’s Carbon Border Adjustment Mechanism assists importers and suppliers in verifying and automating the computation of emission data to mitigate the possibility of penalties.

Why we take your suppliers by the hand?

We ensure accuracy of the Carbon Border Adjustment Mechanism reporting data to prevent importers from facing penalties. Mistakes can lead to severe consequences for importers, such as penalties from the European Commission. Suppliers must provide evidence and calculations, which our platform validates. If there are any issues, we promptly notify the importer and suppliers to protect importers. Our proactive approach helps importers comply with regulations and avoid penalties which will benefit the supplier-importer relationship.

CBAM Compliance Platform

Smart Compliance Reporting

“A unique, innovative data tool.”

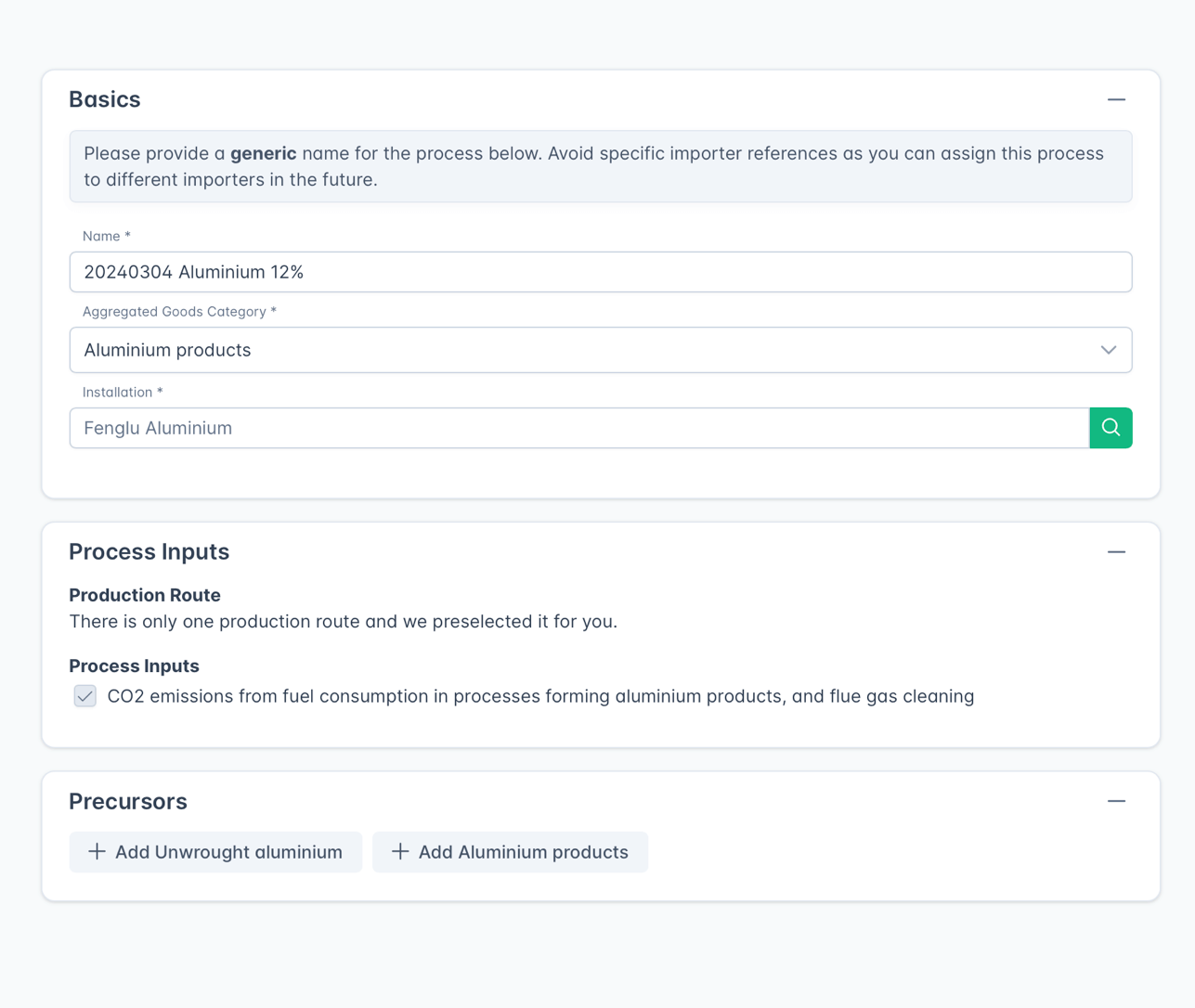

Submit Carbon Border Adjustment Mechanism reports effortlessly with just one click, as suppliers are guided through the process within the system, minimizing errors and simplifying the overall procedure. Invite suppliers and their sub-suppliers, aided by our platform, to submit their emissions, proof and calculations.

Mitigate Importer Risks

“EXPERT ADVISE ON DEMAND, EVERY SECOND”

Dubrink’s Carbon Border Adjustment Mechanism platform minimizes importer risks by enforcing transparency, supplier accountability, comprehensive auditing, and rigorous validation. These measures ensure accurate emission data, reducing the potential for penalties and compliance issues.

Intuitive Data Entry

“LET DUBRINK’S SOFTWARE FILL THE BLANKS FOR YOU .”

Dubrink’s platform is designed to streamline workflow by automating data entry. It proactively fills in supplier information, saving you valuable time and minimizing errors. Say goodbye to tedious manual data input and hello to a smoother, more accurate process. Experience the future of compliance management with Dubrink!

AI CBAM Consultant

“Dubrink’s platform shields us from risks.”

Leverage Dubrink’s AI consultant for Carbon Border Adjustment Mechanism inquiries. Our AI navigates complex legislation, providing swift and accurate answers, saving you time and some consulting fees. Access Carbon Border Adjustment Mechanism knowledge instantly. The perfect guide for importers, suppliers, and representatives.

Audit Archive Platform

“our backbone during inspections”

Even after suppliers have moved on, our system preserves every detail for your historical records and audit readiness. With Dubrink’s Carbon Border Adjustment Mechanism Compliance Software, you can access critical insights and information whenever you need them. Partner with Dubrink today and experience the confidence that comes from knowing your data is in safe hands for the long haul.

Easy Supplier Communication

“Using it is a breeze!”

Connect seamlessly with third-country suppliers using Dubrink’s compliance Carbon Border Adjustment Mechanism software. Access our global supplier database for easy identification and integration of non-EU suppliers’ CBAM data. Our platform empowers suppliers to input relevant CBAM data directly, while providing automated reminders and status dashboards for import and supplier monitoring.

Gemakkelijk CBAM Rapporteren

Platform Ondersteuning

Wij bieden ondersteuning bij het gebruik van het platform zodat u probleemloos kunt rapporteren.

Gebruiks vriendeliijk

Dubrink biedt een gebruiksvriendelijke interface zodat u de juiste keuzes maakt.

CBAM Consultants

Dubrink biedt een uitgebreid netwerk van getalenteerde CBAM-specialisten om u te ondersteunen.

Rapporteer in minuten

Moeiteloze CBAM-rapporteren. In een paar minuten is uw CBAM-rapportage klaar.

Automatiseer

Efficiënte automatisering van gegevensverzameling en rapportage om tijd en middelen te besparen.

Verminder uw risico's

Dubrink helpt u CBAM gerelateerde risico's te verlagen. Nu en in de toekomst tijdens controles.

Data Beveiliging

Dubrink hanteert hoge standaarden om uw gegevens te beschermen en een veilige werkomgeving te bieden.

Flexibel en Schaalbaar

Dubrink biedt een platform dat zich aanpast aan uw behoeften en schaalbaar is.

Betaal naar gebruik

Dubrink biedt een kostenefficiënte structuur. U betaalt naar gelang u het platform gebruikt. Wel zo eerlijk.

★★★★★

"The Platform is brilliant as it allows us to connect with all our suppliers all over the world”

Dominik Mikula

★★★★★

"With Dubrink, suppliers seem to be pretty OK providing the data we ask them for."